Housing

Housing

Securing housing for the family is always important to those relocating to a new city or country. Here, we tackle the issue of what kind of housing you can expect in Vancouver, to help you direct your search.

In this chapter, we cover:

- Finding Temporary Accommodation,

- The Types of Houses in Vancouver,

- Weighing the pros and cons of Renting or Buying a home,

- The different steps involved in Renting Accommodation and Buying Accommodation.

Areas also covered in depth include:

- Mortgage & Owner’s Expenses,

- Utilities & Services,

- Home Insurance,

- Furniture & Appliances,

- Renovations, Decor & Equipment.

You can also read the basics on House Sharing and find out what the expression “Going to the Cottage“ means.

Temporary Accommodation

When you first arrive in Vancouver, a good solution for temporary accommodation is to stay with friends or family. They can be a helpful and a welcome presence, and they can advise you on formalities and cultural differences. However, we know that this is not always possible, and in some cases it can even cause more problems, so we’re providing a whole host of other comfy solutions for you!

Hotels and motels are easy to find and book from abroad, but they can be expensive and not very user-friendly for larger families. Alternatively, staying in a motel located outside of the centre of the city can save you money, but it may also make access to government offices as well as house hunting in the downtown area of Vancouver a bit tricky. If you can manage the cost, you’ll find conveniently-located hotels to suit various budgets on Howe Street, in Gastown on Hastings Street, on Burrard Street, and across the Greater Vancouver Area. For higher-end options, we recommend residential suites at The Residence Inn, Marriott Hotel or the Lord Stanley Hotel.

If you want to feel more at home and have the ability to do your own cooking (think of the savings!), we suggest you look for a fully-furnished apartment available to rent by the week or by the month. They exist at all levels of comfort, luxury and pricing! Fully furnished apartments are a great solution if you plan on buying a house later and/or need time to decide on the permanent housing that is right for you. You can also use listing sites like, Kijiji, Craigslist or Vancouver Short Stay to find tons of temporary rental accommodation options. Many listings on these sites will be from Vancouver residents looking to sublet out their apartments for a period of time.

Some higher end options include the The Rosellen Suites, which offer an all-inclusive home experience, the Time Square Suites, which have furnished suites located near the beautiful Stanley Park, and Delta Vancouver Suites, located in the Heritage District.

Another great resource for furnished apartments is Airbnb. Through this website individuals rent out their homes while they are out of town or living elsewhere in the city. Through Airbnb, you get the home-sweet-home feeling at an affordable price! Airbnb also has a great system of customer reviews and secure online payment that ensures that you are satisfied with your rental before your credit card ever actually gets charged.

If you’re keen to experience the warm hospitality and hearty meals which Vancouverites take pride in, bed & breakfasts can be a great solution, although a slightly expensive one. Bed & breakfasts offer lots of character and comforts of home, including a breakfast meal in the morning. They are often located in charming areas of the city and their owners love nothing more than to sit you down and tell you all about their lovely city! For more information, contact BBCanada and Tourism Vancouver.

If you are renting short-term, make sure you always sign a leasing contract (see Renting Accommodation) and ask for a receipt in case you must leave a security deposit.

Types of Houses

Duplex, single-family, townhouse, high-rise, Vancouver Special, split level, cottage: there are many charming types of houses to choose from in Vancouver!

Vancouver, the most densely populated city Canada, is characterized by high-rise residential and mixed-use development as a solution to battling combating sprawl. The city has the fourth highest quality of life of any city on the planet and is consistently dubbed Canada’s most livable city.

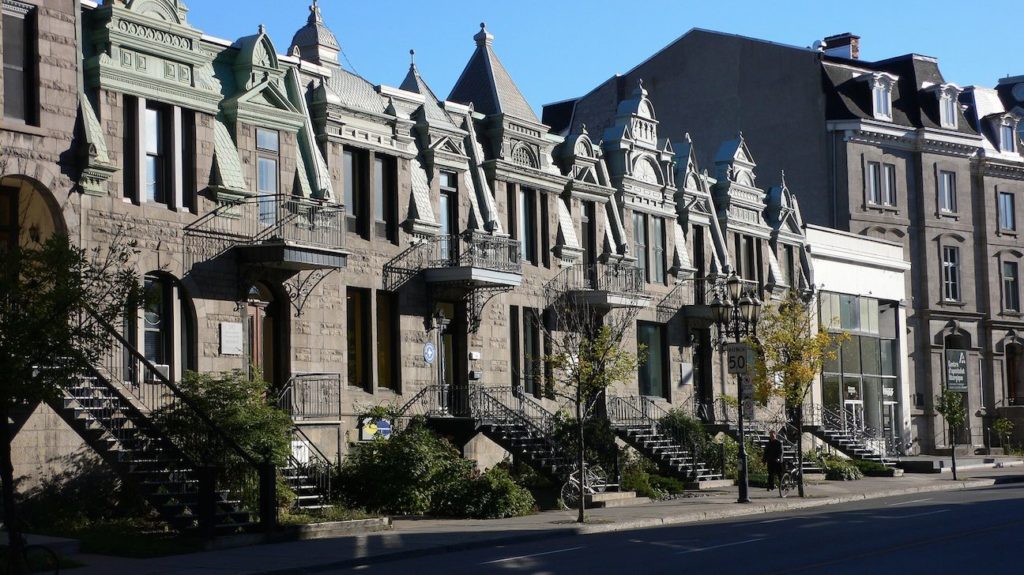

Vancouver is lovingly referred to by locals as a “city of neighborhoods,” and each one a has slightly different style and variety of housing, a different ambiance, and a special local identity. There are about 23 neighborhoods officially recognized by the City of Vancouver, as well as many other unofficial neighborhoods inside the city’s boundaries.

Up-and-coming, trendy neighbourhoods include Yaletown, Kitsilano, Gastown, South Main, Commercial Drive, Hastings Sunrise (east side), Crosstown, and South Slope. The most high end neighborhoods of Vancouver are Shaughnessey Center (west side), West Bay and Sandy Cove (West Vancouver), Kerrisdale Park (south end), Kerrisdale (south end), and Shaughnessy Heights (west side). Great family areas are West Point Gray, Dunbar, Grandview, Mount Pleasant and Riley Park just to name a few! Students tend to live near the University of British Columbia, or in Kerrisdale, Kitsilano, and East Vancouver neighborhoods. Members of the LGBT community sometimes choose to live in Davie Village and on Commercial Drive.

As far as types of housing, the Canada Mortgage and Housing Corporation explains that the central areas of Vancouver, like West End and Yaletown, have high-rise and low-rise apartments, while Fairview and Kitsilano have a mix of housing types and styles. A mix can also be found in the inner suburbs, in neighborhoods like South Cambie and Riley Park. The inner suburbs of South Vancouver feature mostly detached homes. Some outer suburban neighborhoods, including Burnaby’s Metrotown and “The Heights” offer a mix of housing types, while other outer suburbs including Surrey and Langley have mostly detached homes.

Types of Housing:

High-rise towers are defined in Vancouver as buildings that are five or more stories tall that are equipped with elevators. Usually owned by a company that has multiple properties, there are more than 200 of these in Vancouver and high-rise living is growing in popularity. New high-rises are constantly sprouting up. Typically, high rises have intercom systems and parking and laundry facilities for an additional fee. There is often central heat, and the cost could be included in the rent.

Low-rise are from one to five stories, usually made of wood and owned by individual landlords or large companies. There are often building managers on staff to keep the place spiffy, and there are usually staircases, instead of elevators. Heating may be central or by-unit heating, included or not included in the rental cost. Sometimes you’ll find communal spaces like a living room or laundry facilities, as well as storage space. Low rises can offer a higher degree of privacy and rent negotiability than high rises, but they are sometimes perceived to be less luxurious.

Condominiums are growing in popularity in Vancouver! They can be found in high-rise or low-rise structures, and while there may be communal space, individual units are individually owned. Condominiums are thought to be more high-end than rental units, and they are often fully furnished, as well as complete with all your necessary appliances. As a condo owner, you will be able to vote on matters pertaining to the entire property and communal areas. For more info on condos and consumer protection, visit the Condominium Homeowner’s Association of BC.

In Vancouver a Duplex is defined as a building that has only two dwelling units, one of which is fully or partially on top of the other. There are also triplexes and larger attached plexes. You can find semi-detached and standalone buildings throughout Vancouver, too. You will also find both historic and modern townhouses. This is a type of single-family house that is in an attached row along a street (in “row house” fashion). It has two or three stories and often a backyard.

When you leave the urban neighbourhoods for the residential and suburban areas, what usually matters most to prospective homeowners is space. Houses are divided between detached, semi-detached and condos/apartments. You can choose one of these options based on whether or not you prefer to share the whole building, just a wall with another family, or nothing at all!

A bungalow is a one-storey house, as opposed to a storey house, which Vancouverites tend to find more desirable. A split-level is when different parts of the house are on different levels, giving it a modern, “loft-like” look, whereas a cottage has a more traditional and rustic layout, often with a central hall plan.

Styles of housing and buildings:

Vancouver’s eclectic architectural style borrows from a number of historical and modern movements. You’ll find elements of West Coast Style, a modernist form of architecture that embraces open space, overhanging flat roofs, large, sun-facing windows, wood finishes and open floor plans. You’ll also find stunning Edwardian buildings in the downtown core, with ceramic tile, brass-gilt doors, and art deco style. In the late 20th and the 21st centuries, Vancouver begun to get a reputation as the “City of Glass.” More and more, buildings are built with large glass walls, exterior spaces with glass canopies and terraces.

Other housing styles include, but are not limited to, Victorian Housing, Queen Anne Revival, Vancouver Craftsman, Tudor Revival, Dutch Colonial Revival, Moderne, and the city’s very own unique Vancouver Special. The Vancouver Special is a bit like a two-storey ranch house that was developed as a result of city setback laws in the mid sixties.

Up Close: The neighbourhoods of Vancouver

Renting or Buying?

For newcomers to Vancouver, you can easily share or rent an apartment or house. Buying a house, however, can prove much more challenging. There are advantages and drawbacks of each option that depend mostly on your legal status here, your intention to stay, the size of your family and your financial means.

In general, homeownership is very attainable in Canada, but in Vancouver, it will be difficult for newcomers to qualify for a mortgage. Additionally, the housing market is competitive and fast-paced, and because of a high demand, buying prices are steadily on the rise. Vancouver homes tend to be the most expensive in Canada! They are even more pricey than those in Toronto and Calgary. Keep in mind that homes in Canadian cities are be more expensive in general than those in rural areas and surrounding towns.

Despite the costs, more than 60 per cent of people living in Vancouver and its suburbs own their homes. The prices of Vancouver real estate rises year by year, as the city’s population grows. According to Zolo, the average sale price of Greater Vancouver Area (GVA) single-family detached homes was $1.3 million CAD in September of 2018, which is a slight drop from the record-breaking prices of 2016-17 . Within the city proper, the average home prices have been falling even more dramatically. For example, in West Vancouver the average home prices fell from around $3.5 million in late 2017 to about $2.5 million in mid 2018. On average, condominiums sell for more than $500,000. It’s important to keep in mind, however, that averages do not tell the whole story, and you’ll definitely need to speak with a Realtor for the most current market conditions. The numbers factor in bottom-of-the-line and top-of-the-line houses, and everything in between. There is always a range, so if you are planning on becoming a homeowner, you may see more listings excepted that cost more than this average (or less). Also keep in mind that prices fall when you look for a home outside the Greater Vancouver Area.

There are many conditions that apply before being able to obtain a mortgage (or pre-approval for a mortgage), and it is not the easiest task for individuals and families who have just moved to the country, though that doesn’t mean it’s impossible. For newcomers and temporary residents, renting may be easier and safer, at least while you still need time to decide on your favourite neighbourhood, and whether or not you want to extend your stay in Canada.

If you are planning on only a very short stay in Vancouver, house sharing is the solution that requires the least amount of investment and commitment.

For further information, see our Renting Accommodation, Buying Accommodation and House Sharing sections.

Renting Accommodation

The rental market in Vancouver is growing bigger every year. Whether you seek downtown highrise living, a modern apartment in the Kitsilano neighborhood, or a single detached or duplex home in inner suburban neighborhoods, you’re sure to find the perfect fit.

Finding accommodation for rent is fairly easy and can happen very fast in Vancouver. Wait until you arrive and then check websites like Gotta Rent Vancouver, Kijiji, or Craigslist. Alternately, you can explore the neighbourhoods you like, and keep an eye out for “for rent” signs.

You may be thinking about using a real estate agent to help find a rental apartment. Keep in mind that real estate agents are paid on commission, and it can be costly. Typically, you should be able to find an apartment on your own. Don’t worry, we’re here to share our experience and help you decipher the ads:

- Vancouver apartments come on the market one month before they are available. For example, an apartment ready for occupancy on June 1 will come on the market May 1.

- Apartments are described by their number of bedrooms (and in some cases, number of bathrooms).

- As of October, 2018, the average monthly rent for a one-bedroom apartment in the centre city was 1,945, according to Numbeo. Outside the city, the monthly cost is around $1,485. In the centre city, average monthly rent for a three-bedroom apartment is about $3,600. Outside the city, a three-bedroom apartment costs on average $2,600. Please note that averages are a determined based on a wide range of all rental prices found in Vancouver, including apartments in which the tenant has lived for many years, so the rent has not increased (and it is much lower than rentals on the market). These numbers also include luxury and high-end options. Most likely, you will be able to find a range of rental prices, but don’t be surprised if the accommodations you seek they are a bit higher than the averages.

- In a fully furnished apartment, all furniture and appliances are provided so you will only have to bring your personal belongings.

- In a semi-furnished or fully-equipped apartment, the major appliances, including the refrigerator, stove, and sometimes even the washer and dryer, are usually provided and included in the rent. Laundry machines also are sometimes available in a common laundry room in the building. When the ad says “washer-dryer plugs” or “hook-ups,” it means the electrical wires and water hoses exist to plug in your own appliances. If not, you’ll have to discover the pleasures of our laundromats!

- Sometimes the heating and/or electricity is included. Make sure to ask, as this is not a given. There are both pros and cons to choosing a rent that includes these costs. A pro is you will have a clear idea of what your monthly expenses will be, but a con is you have less control over how much you pay.

Once you’ve found your home sweet home, you will have to sign a lease. Though landlords can create their own tenancy agreement forms, tenancy agreement templates are provided by the Residential Tenancy Branch, and are in compliance with the Residential Tenancies Act. The agreement must include information about who the agreement is between, the fixed length of the agreement, rent, deposits, pets and more.

According to the Residential Tenancies Act. The maximum security deposit landlords are allowed to charge is a half-month’s rent. If pets are permitted, they can charge another half-month’s rent. Additionally, landlord are permitted to charge deposits for items like additional keys and garage door openers. There is an interest rate of 4.5 percentage points below business prime on January one, which must also be returned to the renter, if there are no damages to pay for. Some landlords also charge a small fee for applying to live in an apartment.

In British Columbia, the majority of leases are month-to-month, though there can be fixed-term leases for a week, month or year. The province has rent control, which means landlords need to provide three-months notice before increasing rent. The current allowable increase amount is 3.8 per cent. In order to increase rent higher than the allowable amount, landlords need to get tenant consent, or get an order from the Residential Tenancy Branch.

If you wish to leave a rented apartment before your lease is up, tell your landlord. He/she can accept to let you cancel your lease if he/she intends to take back the apartment or rent it on a new lease. In this case, you may be legally charged a “liquidated damages” fee, to cover the costs of finding a new tenant. Otherwise, you may have pay your rent until your lease is up.

In rare cases, you may also have the opportunity to find a new tenant and arrange for a lease transfer, but only if your landlord agrees in writing. The landlord has a right to refuse an assignment if the new renters you find have a history of problems with past landlords. We do not recommend subleasing or subletting, since you remain legally responsible for the apartment and rent after you’ve moved out and for the whole remainder of the lease period.

If your landlord needs to end your tenancy early, he/she is required to provide notice, depending on the situation. For example, 10-days of notice is required for non-payment of rent, one month for cause or conduct, and two months if the landlord is using the property for another residential tenancy.

If you have questions, or in case of a conflict with your landlord, go to the Residential Tenancies Branch. In British Columbia, officials try to ensure both the rights of landlords and tenants are protected.

Buying Accommodation

Because of high demand, Vancouver’s housing market is very, very hot. But after soaring to record high prices in 2016 and 2017, the market has shown signs of softening in 2018. Even so, the average sale price of a detached home in the Greater Vancouver Area (GVA) was about 1.3 million in October 2018. In central Vancouver, the volatility has been even more dramatic, for example in West Vancouver, the average price dropped from about $3.5 million in mid 2017 to about $2.5 million in mid 2018. So you’ll definitely want to speak to an expert for the most up-to-date market conditions.

But softening market or not, housing in Vancouver remains incredibly competitive and turnover is very fast in the city. There are also bidding wars and sometimes sellers will “hold back offers.” Holding back offers means sellers are expecting a bidding war, and they are also expecting to get at least the asking price. After purchase, move-in dates (a.k.a. the possession dates) are negotiable and determined by the individual contract between the seller and buyer, but this also tends to happen very fast.

For a newcomer, obtaining a mortgage necessary to purchase a home isn’t super easy. There are many conditions that apply before being able to obtain a mortgage (or obtain pre-approval for a mortgage), and it is difficult for individuals and families who have just moved to the city.

It’s best to deal directly with a mortgage broker, and be pre-approved for your mortgage before you start house hunting. It takes time to be approved and you would likely lose the house during this time. To get a mortgage, you must “qualify” for it, and a mortgage broker will tell you what you need.

There are, some important preliminary steps you should take if you plan on receiving a mortgage. These include:

- Securing a credit letter from your existing bank that clearly outlines how long you have been banking,

- Obtaining an Equifax report that covers all the information about you credit rating and assets. Most companies are now affiliated with this service and it will help to show lenders your credit rating.

- Finally, it would be incredibly beneficial to either have significant savings in the bank, and then borrowing against the money you already have or get a guarantor (someone who is willing to cosign on the mortgage with you).

When finding a property in Vancouver, our first big piece of advice is to work with a real estate agent! To be realistic, you’re a newcomer. You don’t know the market, the vocabulary or the procedures. Plus, it is the seller who pays the commission (the seller’s agent will split his commission with your real estate broker), so why do without? It may also be wise to avoid buying directly from the owner without consulting a professional (real estate broker, notary or lawyer).

Aside from a real estate agent and and a mortgage broker, you’ll also need to work with the following team of professionals:

- A lawyer who will protect your legal interests by ensuring the home is free of liens, charges or clean-up orders, and review all contracts before you sign them,

- A professional home inspector who will look through the property and inform you of what is not working or needs repairs,

- An insurance broker who can help you acquire property and mortgage life insurance,

- An Appraiser who will assess the value of the property, and

- A land surveyor in the current owner does not have a Survey that’s up to date, or a Certificate of location.

You can benefit from ARIANNE’s housing posts on the Blog, where you’ll likely find some contact information for some of the best real estate brokers in the region. We don’t advertise for and real estate brokers or agents that we write about, we recommend them. We feature them because they are good and we know for a fact they can be fully trusted. If you don’t like them, let us know!

When you’re ready to start looking, you can use the website Realtor.ca. This site centralizes listings of all properties for sale, whatever the agency – it’s very convenient! Real estate agents can give you access to an even more personalized and complete database of properties for sale. They will also help you with real estate language and teach you what to pay attention to, but here is some information to start with:

Condo, divided, undivided: these terms describe different types of co-ownership:

- In a condo, individual owners possess their own apartment within a larger building. They participate financially in the maintenance of the building by paying condo fees to administrators. This can also sometimes apply to houses, detached or not, in a community, often known as a “gated community.” A condo is technically synonymous with “divided co-ownership” but is most commonly used to describe new or recent buildings. Divided co-ownership applies to a few smaller buildings. You can either live in your condo or you have the right to lease out your space.

- In an undivided co-ownership, two or more people collectively own a single property. Taxes and maintenance are collectively paid according to a legal agreement between the owners (so they are cheaper). Each party owns his or her share and is allowed to sell it (co-owners have preemptive rights to buy it). Here, there’s no division between private and common spaces, as owners have purchases a “share” rather than a “unit.” Leasing it is technically forbidden. It is a little more difficult to sell than a condo. These kinds of ownership agreements are not as common in British Columbia.

Bedrooms and bathrooms: In addition to square footage, size and prices of houses are determined by their number of bedrooms and bathrooms. In order to be considered a bedroom, a room must have a window (or natural lighting), a closet, and an interior closing door.

Basement: “Finished” or not, a basement gives you the possibility to double the surface area of your house! Many Vancouverites enjoy adding a bedroom for their teenagers or elderly parents (in a “multi-generational” home) or have a big cozy family room downstairs with a home cinema and even a fireplace for those cold winter months! In some cases, building a finished basement requires a building permit, inspections, and may lead to a tax increase. Get more information from the City of Vancouver here.

Prices: Selling prices are usually negotiable. Explore Vancouver by neighbourhood, online or with a professional, to learn more about real estate prices. Be sure to pay attention to heating prices, as well as city and school taxes, if they are specified (see Mortgage & Owner’s Expenses).

In Depth: Real Estate in Canada

Mortgage & Owner’s Expenses

For a newcomer, obtaining the mortgage that is usually necessary to purchase a home is no easy task. There are many conditions that apply before being able to obtain a mortgage (or obtain pre-approval for a mortgage), and it is extremely difficult for individuals and families who have just moved to the city.

It’s best to deal directly with a mortgage broker, and be pre-approved for your mortgage before you start house hunting. It takes time to be approved and you would likely lose the house in the time it takes to get approved. To get a mortgage, you must “qualify” for it, and a mortgage broker will tell you what you need.

There are, however, some important preliminary steps you should take if you plan on receiving a mortgage. These include:

- Securing a credit letter from your existing bank that clearly outlines how long you have been banking,

- Obtaining an Equifax report that covers all the information about you credit rating and assets. Most companies are now affiliated with this service and it will help to show lenders your credit rating, and

- Finally, it would be incredibly beneficial to either have significant savings in the bank, and then borrow against the money you already have, or get a guarantor (someone who is willing to cosign on the mortgage with you).

To obtain a mortgage, or loan to buy a house, you will need a down payment. As a newcomer, it is best if your down payment is at least 20 per cent of the value of the house (this percentage is usually 30 per cent if you buy an undivided property, newcomer or not). In Canada, if you do not have enough to make a 20 per cent down payment, it is sometimes possible to purchase a house with only five or 10 per cent down, provided you meet the solvency requirements of the Canadian Mortgage and Housing Corporation (CMHC). Qualifying guidelines vary depending on the lending institution, but in general, in order to meet the requirements, your total debts, including all your credits and the expenses linked to the house (the mortgage payment, insurance, school and city taxes, and heating), must represent less than 30 per cent of your income.

Most financial institutions have an online mortgage calculator you can use to help determine costs. You may choose the length (up to 25 years) of the loan and the frequency of payments. You are required to renegotiate your loan (interest rate, fixed or variable rate, and term) every five years or so. In Canada, your mortgage payments are not tax deductible unless your property is used for generating revenue (such as home rentals, home offices or commercial properties).

Make appointments with mortgage advisors from several banks to assess your assets and evaluate your home purchasing power and loan possibilities. You can find online calculators, but since newcomers’ situations are often unique, it is best to see someone in person. Some banks have mortgage and banking solutions adapted to new residents, like CIBC and Royal Bank of Canada.

NOTE: As of January 1, 2018, some stricter mortgage policies went into effect. According these new federal guidelines, anyone applying for a loan, regardless of the size of their down payment, will be closely scrutinized to ensure that they would be able to make payments, even in an environment of rising interest rates. Furthermore, those with down payments below 20% are required to purchase mortgage insurance, to protect the lending industry from a bursting bubble scenario. The Trudeau government enacted these rules as a way of slowing down runaway home prices and an impending affordability crisis, particularly in markets like Toronto and Vancouver. For the same reason, the Ontario Providence has also passed a 15% non-resident speculation tax.

Taxes and expenses:

As a homeowner in Vancouver or another municipality, your property tax notices will come from the municipality. It will collect taxes for the provincial government (school and policing), regional hospital districts, the British Columbia Transit Authority, Translink, BC Assessment and the Municipal Finance Authority. You pay taxes annually according to the surface area and assessed value of your house. Even though there are various forms of taxes, all the tax is collected by the municipality, so you conveniently receive just one bill. The rates depend on the district or city you live in. Usually the tax amounts are indicated in the real estate advertisement: you will have to take them into account when calculating how much the house will cost you, as well as heating expenses. For more information, visit the City of Vancouver’s Property Tax and Utilities webpage.

To buy any property in Vancouver, you will have to pay the Property Transfer Tax (PTT), which is payable on the fair market value of the home.

Here is a breakdown of how the PTT is calculated:

- 1 per cent on the first $200,000 of the fair market property value.

- 2 per cent on the rest of the fair market value (more than $200,000).

This means, for example, that if the market value for your home is $500,000, you will be taxed $2,,000 on the first $200,000 and $6,000 for the remaining $300,000, for a total PTT of $8,000.

This may sound like a pricey addition to your property costs, but there is help for first-time buyers. Partial refunds or total exemptions are available. Some of the requirements include being a Canadian Citizen or Permanent Resident, having lived in British Columbia for 12 consecutive months, having filed at least two income tax returns in the last six years, having never owned an interest in a principal residents, and having never received a first time home buyers’ exemption or refund. Read more about PTT exemption and refund qualifications here.

You must also consider paying legal costs, which are usually from $800 to $1,100 whether you use a lawyer or public notary, and a five per cent Goods and Service Tax (GST) applied to the first occupants in a new or drastically renovated home (though there are rebates available of up to 36 per cent if the buyer will be the principal resident).

There are appraisal fees when the lending institution requires an appraisal of the home before you can obtain a mortgage, and there are also third-party closing costs, including a a municipal tax certificate, which ranges from $25 to $50, an insurance binder, from $25 to $40, and survey fees of about $200 to $250, other fees.

Your mortgage lender will also require you to purchase Fire and Liability Insurance and Mortgage Default Insurance. And you may want to buy Life and Disability Mortgage Insurance, which could ensure the remainder of your mortgage gets paid should you become deceased.

Additionally, it is advisable to plan a financial “cushion” just in case of any other unforeseen expenses. Moreover, if you’re getting a mortgage, plan to pay a from two to seven per cent interest rate per year (depending on the type of mortgage, and the average is about 3.8 per cent) and between one per cent and four per cent for a mortgage insurance (depending on the percentage you bring, your professional situation, etc.).

Make appointments with mortgage advisors from several banks to assess your assets and evaluate your home purchasing power and loan possibilities. You can find online calculators, but since newcomers’ situations are often unique, it is best to see someone in person. Some banks have mortgage and banking solutions adapted to new residents, like CIBC and Royal Bank of Canada.

In Depth: Mortgages in Canada

Utilities & Services

Once you’ve arranged your housing, it’s time to get utilities, from garbage collection to internet connection.

Municipal Utilities:

Connecting your house or apartment to municipal services like water and garbage collection is easy. Vancouver provides water distribution and garbage collection, as well as yard trimming and recycling collection. Bills for water, sewage and solid waste collection should come three times a year in March, July and November. If you live in a single-family home or duplex, you get a flat-rate bill for garbage and yard trimmings carts, recycling, fire line, and cross connection fees, which comes once a year and are due the second business day in July.

In the City of Vancouver, water rates are lower from October to May, when water is more abundant. It goes up by about 25 per cent for the rest of the year. Seasonal rates are meant to help the city reach its water conservation goal of reducing use by 33 per cent by 2030.

Fees for solid waste and recycle collection are quite small. You can find garbage and recycling schedules by typing in your street address here. Find out more about waste disposal and recycling here.

Aside from water and waste, you’ll need to set up your gas and electricity utilities. Both gas and electricity are used in British Columbia. Gas is the common way of heating and air conditioning a house. Some people to have electric heating systems, but these are significantly more expensive to keep up. Electricity (called “hydro” in British Columbia because it is powered by water) is used for lights, outlets and other power.

Electricity:

In general an electricity bill in Vancouver tends to be from $30 to $120 per month, depending on the season and whether or not you use electricity to heat and cool your home.

In British Columbia, BC Hydro is the main source of electricity. It operates 31 hydroelectric facilities and three natural gas-fueled thermal power plants. Electricity is transported through transmission lines to 1.8 million customers!

The rates for electricity vary depending on the time of use. For a complete list of energy distribution companies serving British Columbia, click here. Rates are a reflection the generation, transmission, distribution and customer service costs of providing electricity to customers.

When you move to Vancouver, you’ll need to set up your electricity account. If your place of residence already has a connection, just know your service address and create a create a MyHydro profile. If you require a connection, you’ll need to make a request with BC Hydro. Here’s information from BC Hydro about how to proceed.

Natural Gas:

In British Columbia, natural gas is also a popular energy source. The British Columbia Utilities Commission regulates the rates that utilities are permitted to charge customers. FortisBC is the most commonly used company that distributes natural gas to British Columbia and the City of Vancouver, distributing to about 920,000 customers.

Costs usually peak during the coldest months of the year. Depending on the size of the housing unit you need to heat, how much natural gas you use, and the time of year, you could pay from $30 to $300 per month (for a very large house) for natural gas.

To stop, start or move service with FortisBC, go here. You can also open your new gas account with FortisBC by calling 1-888-224-2710. You can start, stop, and pay for natural gas services online here.

Electricity and heating must always be on in winter, even in an empty house, to prevent freezing water pipes! Think about setting the heating at 15 degrees celsius when you leave for the weekend.

Communication services:

Once you have electricity and heating, all you need to be fully set is a telephone landline, Internet, and cable TV, commonly referred to as a bundle. The more services you purchase from one company (they also do mobile phones), the more discounts you will get. Shaw, Novus and Telus are the three big companies. It’s usually approximately from $100 to $120 for a basic bundle.

According to our sources, Novus is likely the best option of the three. Novus offers the best internet minimum and maximum upload and download speeds. Novus also comes out on top when it comes to bundle options available. For internet alone, Novus internet starts at $37.50, Shaw at $50 and Telus at $45. On the other hand, Shaw and Telus have greater availability than Novus.

Smaller, sometimes cheaper internet providers exist (like Juce, Lightspeed, Urbanfibre) and some Vancouverites choose these because they find better deals or more reliable service than larger companies.

Local calls are free with your landline (numbers with the local area codes 778, 236), whether you call a landline or a mobile phone, but intercity calls (incoming and outgoing) can be very expensive. A lot of Vancouverites and expats buy calling cards in convenience stores and use them at home. Or they use calling services offering discounts on long-distance. In this day and age, people are able to make free long-distance calls (and video chats!) through web platforms like Skype, Google Voice and even Facebook, among others. If you have a Shaw or (in most cases) Telus landline service you can dial 10-10-710 before your correspondent’s number, and a discounted price of the communication will appear directly on your phone bill. If you plan on doing a lot of talking with your friends and family back home, most phone service providers have long-distance plans.

Basic cable TV includes mostly English language channels. The public broadcast channels include CTV and CBC, CityTV, Omni , Global and more. There are all kinds of packages available, and you can even build your own package.

Mobile phone providers are numerous. There are Fido, Rogers, Telus, Virgin Mobile , Bell, Citifone, Telus, Primus and other smaller, local companies. You can get a basic package for $30 per month. However, remember the following: unless you choose an unlimited voice and texting plan, you pay for both incoming and outgoing calls and text messages. Voicemail and caller ID cost extra, and 3G Internet charges are applied based on your data usage on your smartphone. You can get an unlimited voice and texting plan covering all of Canada, plus a decent data package for a total of around $65 per month. Smartphones go for from $0 to $200 if you sign up for a two-year plan.

Read all lines of your contract carefully and don’t forget to include the taxes in your calculations!

Other services:

You may also need a housekeeper or house staff. Job placement agencies like Randstad can help you. You can also count on the ads on Kijiji, use your network (if you have one) or go to specialized websites, like Maid Natural Cleaning, which offers eco-friendly cleaning services.

For more information on garbage and recyclables collection schedule, you can contact your municipality (call 3-1-1) or visit The City of Vancouver website. Almost every community in Vancouver has a recycling program, so you are encouraged to sort your garbage. Some cities also organize the collection of organic waste for compost.

Your local municipality is a good resource in case you suffer an unfortunate invasion of bedbugs. City officials can help you force your landlord to take rapid action (which is crucial) and give you contact information for exterminators (this information applies to other pests too).

Furniture & Appliances

If you don’t want to spend too much money on furniture and appliances, you can always buy them second-hand. When the weather is nice, you shouldn’t be surprised to see garage sales and yard sales every weekend between June and September. They are popular in Vancouver and can be lots of fun! The rest of the year, Kijiji is full of ads for furniture and appliances: sometimes they are even free if you are willing to pick them up and transport them. Of course, in the case of garage sales and classified ads, you have no guarantee of the items’ quality or working condition, so buyers beware!

Shopping at secondhand stores such as Value Village can be a good way to save money while supporting the less fortunate. Secondhand appliance stores usually have delivery services and sometimes a small warranty (up to one year). If you have a taste for antiques, hurry up and explore ReFind, C’est La Vie, or Second Time Around all on Main Street in Riley Park, or Stepback on West Broadway Street in Kitsilano, before that gorgeous Louis XV buffet table disappears.

To buy new furniture, electronics and appliances, British Columbians go to large chain stores such as Hudson’s Bay, Walmart, and Bowring, typically located in suburban malls. Look out for special offers! Ikea also has stores in Canada. There is one located at 1475 The Queensway. These large chains will offer warranties and delivery services. All of these major stores accept credit cards and have payment plans, a good way to start building your credit history in Canada, if you’re eligible (see Credit)!

For new home goods, Ikea furniture is fairly priced, so you could furnish your apartment for under $2,350 CAD. Double beds begin at $400 at Ikea, and sofas tend to hover around $800.

For appliances, plan on at least $1,000 for a refrigerator and stove, $800 for a washer and a dryer, $600 for a dishwasher, $200 for a vacuum and a coffee machine and $100 for a microwave (these costs vary depending on the models of appliances, and whether they are used or new). All these prices are the minimum estimate.

Renovations, Décor & Equipment

If you need freshly painted walls, new shelves and cute doorknobs to feel at home, look large hardwares stores like Rona and Canadian Tire, or one of the many smaller hardwares stores throughout the city (Atlas Machinery, Dudley Hardware, and Home Hardware, among others, are all located in the downtown core). Rona has bigger stores in the suburbs and Home Depot has locations all over Canada.

You can check Kijiji or the Yellow Pages if you need a contractor to help you, but it is best to work with trustworthy people and use your network (ask your neighbours who built their back deck, for example). Since Vancouverites jokingly refer to renovations as the second national sport after hockey, you’ll have no problem finding a designer. Just remember that you usually need permits from the city or borough before undertaking major transformations, so check with your municipality. Applications for a permit need to be handed in to the customer service counter located within the district where the project will happen.

For all household equipment like pans, toasters, hair dryers, microwaves, etc., most large department stores will do, but the best place to go is Canadian Tire. They sell all sorts of equipment for your home and garden, including sports equipment, camping gear, Christmas decorations, BBQs and lunch boxes! They also offer car parts and maintenance. We recommend you buy only if it’s a special offer, since sales happen regularly. If not for a great deal on a socket wrench set, you have to go to Canadian Tire for the cultural experience, as many Canadians are really into the idea of DIY (do-it-yourself) renovations. Another way to try a uniquely British Columbian shopping experience is to check out a dollar store, like the popular Dollar Tree or Dollarama. If you want trendier, contemporary furniture, kitchenware and home decor, visit West Elm in Granville, Nono Furniture in Riley Park or Living Space, located on West 1st Avenue. There are also plenty of smaller, independent, decoration and antique boutiques throughout Vancouver.

Good News: Vancouver Goes Green

Home Insurance

Once your new home is all set, you might want to purchase home insurance, which typically insures your home content, damages to the property and third person accident liability. While it is not compulsory in British Columbia, if you want to have a mortgage you will be asked to have home insurance. You can contact an insurance broker or one of the following insurance companies directly: Allstate, State Farm, Canadian Direct, Intact, etc. Go to ARIANNE’s Blog to find more tips and advice from experts on home insurance.

All of these companies have home and car insurance, and offer discounts when you purchase both. Some also offer complementary health and life insurance. Other ways to save on the cost of insurance are: having a home alarm system, being non-smokers and living in a newer building. Note that you cannot get insurance coverage if you live above a restaurant or a bakery. Read the entire contract, including fine print, and ask about exclusions and deductibles before signing anything.

Canadians, on average pay about $850 per year for home insurance.

House Sharing

Ready for cultural immersion? House sharing is a common practice in North America, and it’s not limited to students.

The most obvious advantage is sharing the price, but there are many others, especially for newcomers. Sharing a house with Vancouverites will facilitate your cultural integration, and it’s a good way to learn one, or both, of the official languages. If you move in as a roommate to someone who already has a house or apartment, the rent is often all-inclusive: furniture, electricity, cable TV and Internet. This helps when you’re busy settling in.

The quality of a house sharing experience depends completely on personal affinities between the housemates, so don’t hesitate to meet everyone before you sign on. Be conscious also that a minimum, predetermined amount of investment in administration and housekeeping is necessary. The clearer the communication and organization, the better!

When searching for a roommate, there is some important information to keep these ideas in mind:

- Remember that first impressions are meaningful! How does the person make you feel? Are they relaxed and are you comfortable around him or her? Talk to this person a lot before deciding, to make sure it’s a good match.

- It can be a good idea to share a living space with a member of the same sex. This might help avoid any possible awkward situations.

- Try and decide ahead of time how many roommates you would feel comfortable living with.

- If you are renting an unfurnished home together, discuss ahead of time how costs will be shared for furnishings, to avoid any problems.

To find your ideal roommates, you can check the bulletin boards in universities or campus cafés. Kijiji and Craigslist often have ads for house sharing and there is one specialized website: EasyRoommate.com.

Going to the Cottage

After some time living here, you may wonder what people mean when they say “we’re going to the cottage this weekend,” or when they mention “cottage country.”

It’s a cultural habit, all year-round, to escape the city for the countryside, preferably with lake or mountain nearby. And when you start to discover the beautiful natural landscape around Vancouver, it’s easy to understand how this habit developed. Of course, not every Vancouverite has a second home, but many have a small cottage where they spend summer weekends, which some also rent out. It is not always the traditional log cabin you may have fantasized about, but we definitely recommend that you give it a try!

Cottage rentals are a real industry. Visit CottagesRental, and who knows, you may eventually find yourself wanting to buy (or build!) your own cottage or cabin in Canada!