Canada has one of the most conservative and safe banking systems in the world. There are five major banks called the “Big Five” in Canada:

- Royal bank of Canada

- Toronto Dominion Bank

- Bank of Nova Scotia

- Bank of Montreal

- Canadian Imperial Bank of Commerce

In the Province of Quebec, you will also find very often the Desjardins Bank.

Banks in Canada function much like most banks in the rest of the world. They offer similar products such as checking accounts and credit cards. They have a high level of security and great customer service. Canadians are very proud that in the 2008 world crisis, Canada’s main industries and housing was not hit as bad as other countries. There is no wide spread sub-prime mortgage issues as Canadian banks do their due diligence of the people applying for home loans.

Recently all banks started offering a new product called “tax-free savings account”. I suggest you see if this is something that could be beneficial for your situation.

The Bank of Canada, acting as the nation’s central bank, has “to promote the economic and financial welfare of Canada.” Bank of Canada’s most important tool is to influence interest rates either by raising or lowering them. The announcements are made eight times a year on fixed dates.

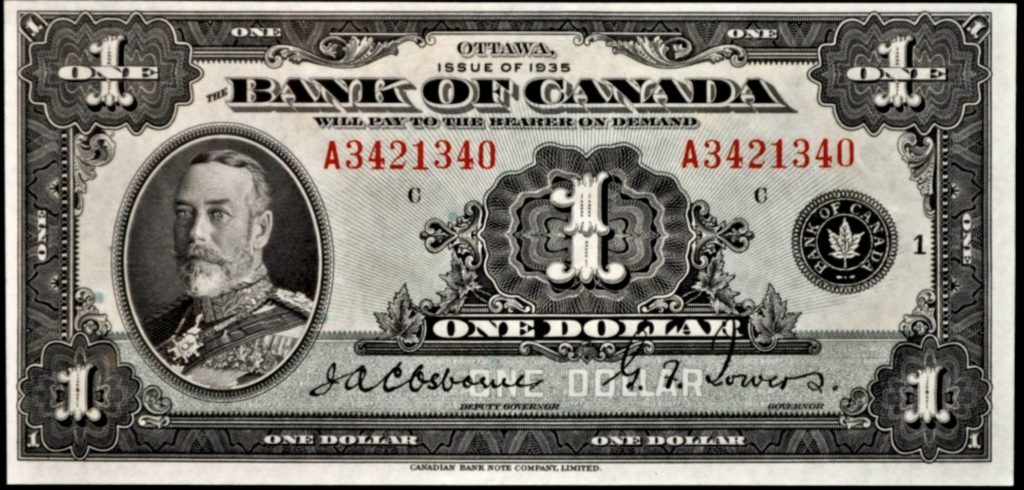

The Bank of Canada designs, produces and distributes all bank notes. Their mandate is to be prepared to supply financial institutions with enough bank notes to satisfy public demand.

Just like we all have personal accounts in our own banks, the Canadian government uses The Bank of Canada for their funds management. The Bank manages the money collected and spent by government flows, foreign exchange reserves and the public debt.

Recently, The Bank of Canada celebrated 75 years of central banking and is one of Canada’s Top 100 employers. Although the 2008 world financial crisis had an impact on many economies, Canada is part of a few nations which recovered quickly and are currently showing growth. In large part this is due to the strong central bank and a more conservative banking system.

Photo Credits: Wikipedia

Leave A Comment